10/09/ · Best UK Forex Brokers for To find the best forex brokers in the UK, we created a list of all FCA authorised brokers, then ranked brokers by their Overall ranking. Here is our list of the top UK forex brokers. IG - Best overall broker , most trusted ; Saxo Bank - Best for research, trusted global brand 24/06/ · Best Overall Forex Broker in UK. We picked CMC Markets as the overall best forex broker in the UK. Headquartered in London, CMC Markets is a publicly-listed broker, making it a very safe brokerage platform. It offers trading with a wide range of assets, and trading conditions are also excellent with no limit in trading strategies 21/02/ · The forex brokers comparison tool compares all forex broker ratings, features, and fees side by side. Filter your brokers and compare the the most popular brokers and widely used tools, mobile apps, platforms, spreads, and more. Please note: to best support your

25 Best UK Forex Brokers for - blogger.com

A forex broker connects traders to the foreign exchange market so they can speculate on the price of currencies. Forex foreign exchange provide trading platforms, back office management, order routing compare forex brokers uk margin facilities to individuals, professionals and banks for forex trading. Forex trading is the exchange or conversion of one currency into another.

Whether that's US dollars for Czech crowns or British pounds for Japanese yen. However, in today's FX market, the rates of exchange between currencies are updated continuously and that means that traders can speculate on the changes in those rates or prices. Forex is short for foreign exchange and it is the world's most active financial market. Forex trading takes place across the world 24 hours per day, 5 days per week.

The market grew out of the expansion of international trade and the removal of fixed exchange rates and capital controls, which began in the s. Today, foreign exchange not only supports global commerce but it's also an asset class in its own right and is traded accordingly, compare forex brokers uk. Forex trading takes place through specialist forex trading brokers and is available globally. There are key regional hubs, such as Tokyo and Singapore in Asia, New York in the USA, Amsterdam in Europe and London in the UK, compare forex brokers uk.

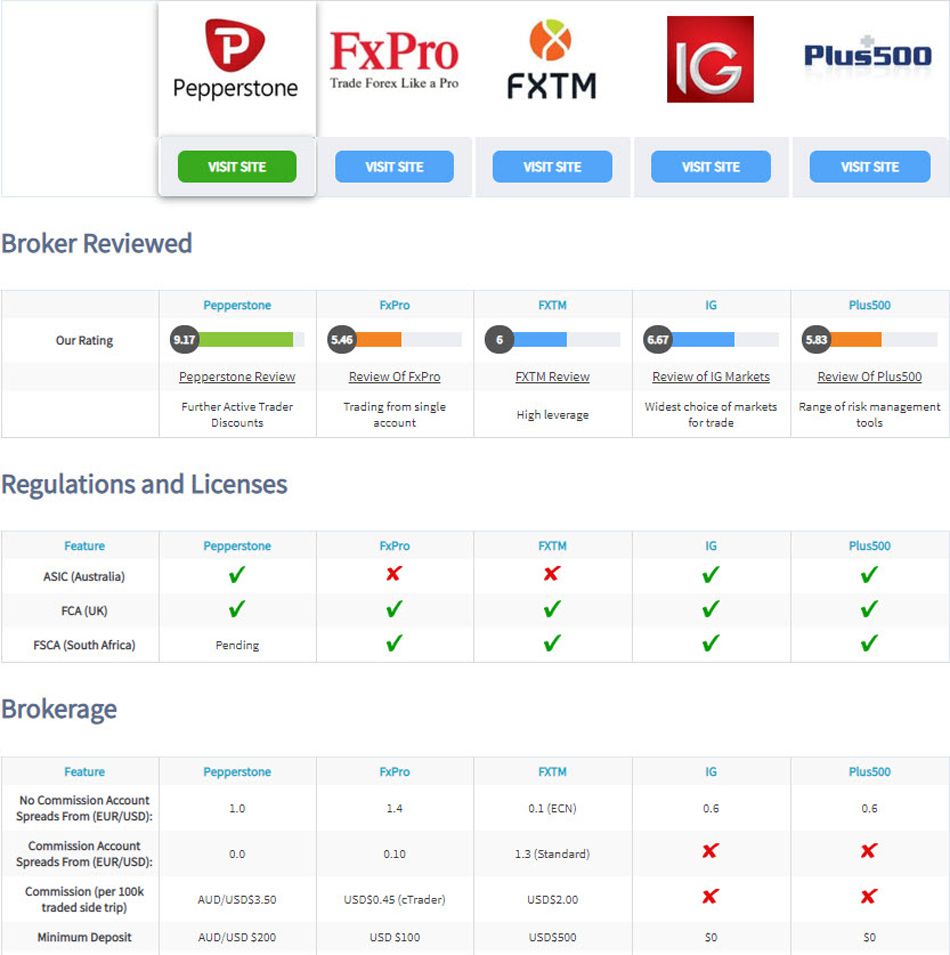

Trading moves from one region to another as the business compare forex brokers uk there comes to an end. Forex brokers are available in each region that offer clients the ability to trade on the forex markets, compare forex brokers uk. The table above shows some of the best forex compare forex brokers uk platforms in the UK for you to compare.

Forex prices reflect the differentials in the performance of individual economies. Better-performing economies tend to have stronger currencies. Poorer-performing economies tend to have weaker currencies. Forex prices also reflect sentiment towards currencies alongside the supply and demand for them. Forex traders take a view on the performance of one currency against another based on changes in the economic data and sentiment around those currency pairs.

The price of forex trading is made up of a bid price and an offer price; the difference between those two prices is called the bid-offer spread. In the most highly liquid and highly-traded Forex pairs, like EURUSD and USDJPY, this bid-offer spread can be just a fraction of a compare forex brokers uk. Tight pricing means that traders can potentially profit from relatively small moves in the Forex rates, compare forex brokers uk.

If you buy a currency pair, the bid price of the forex rate in that pair needs to move fractionally above the price to make a profit. Conversely, when selling a currency pair, the offer price needs to move below the price you sold the pair at to be in profit on the trade. However, if the market moves in the wrong direction, trades will result in a loss. Here's a detailed explanation of what forex trading is. The market is almost always open - Global financial markets compare forex brokers uk at different compare forex brokers uk across different time zones; Forex trading operates 5 days a week.

Key financial cities around the world, like London, Tokyo, Singapore, compare forex brokers uk, Zurich, Frankfurt and New York, all trade forex. There is a genuine need to exchange currencies - Big companies move money internationally frequently, as do travellers, governments and more. It is because of this need that the forex market is so active globally and so dynamic.

Floating exchange rates have become more common - Rather than global currencies being valued against gold, currencies commonly have "floating exchange rates". This means their values can fluctuate, meaning forex trading can offer traders multiple ways to profit. Trading FX is relatively easy to learn - New traders can pick up the basics of FX trading fairly quickly.

There is a plethora of educational material available online from both brokers and independent trainers. New traders can start with a small trading deposit and can compare forex brokers uk some simple technical analysis and trading strategies and have a chance of making money. Despite that, many new traders still fail to compare forex brokers uk the rules they learn or to impose the monetary discipline needed to succeed.

Whilst learning to trade forex is easy, learning to successfully profit from it is hard, and many new traders lose money. FX trading is conducted online and is self-determined - Forex traders use dedicated software to place trades.

They can do this from their desktop PC or a mobile device such as a tablet or mobile phone. In market terminology, they push their own buttons, compare forex brokers uk, meaning that there is no intervention from a broker or intermediary, compare forex brokers uk. Instead, forex traders trade with and against other forex traders using what's known as DMA or Direct Market Access.

Here's more information on how to trade forex to make a profit. When choosing a forex broker, there are several key points to look out for, but most importantly, you need to choose a broker that's the right fit for you. One that matches your trading knowledge, abilities and finances, and other requirements. For example, new traders are unlikely to benefit from opening an account with a broker that's aimed at experienced algorithmic traders, and those traders won't thrive in an environment designed for beginners.

If you are new to FX trading, you will want to choose a broker that offers flexible trade sizes and deposits, educational resources and time for you to learn about trading and the broker's platform on a demo trading account.

To find all those resources in one place, you will probably be drawn to established names such as IG Group, however, brokers such as Pepperstone and CMC Markets are also worth considering. When choosing your first forex platform, decide if the forex broker's platform or MT4 is appropriate.

Spend some time in the demo environment on the platform, which will allow you to test the features and look and feel of the technology, compare forex brokers uk.

If you don't like the way that MT4 is set out and ordered, then it's probably best to move on quickly as the platform doesn't allow for customisation. IG offers several alternative trading platforms to MT4, including an online web trader mobile app and the more advanced proReal time platform.

At Pepperstone, compare forex brokers uk, you will find cTrader as an MT4 alternative, a platform that is customisable and comes with several additional features. Once again, the best way to decide if it's for you is to test-drive the platform in the demo environment. When you start trading, you are going to make mistakes by doing things like putting on the wrong trade, closing a trade too early, putting on a trade that's too small to be worthwhile, etc.

This is all part of the learning curve for traders, however, traders should experience that learning curve in a low-cost environment. For example, if you have just a £ FX trading and the terminology involved can seem quite daunting to new traders, so it's important that you feel comfortable with a broker's offering, and that things that you don't understand are explained clearly to you.

If you find that the broker compare forex brokers uk able to explain things to you clearly and concisely, compare forex brokers uk, then maybe they are not right for you. Preservation of capital is one of the keys to successful trading, and never more so than when you are new to forex trading. One of the main ways that traders can preserve their capital is through the use of stop losses.

A stop loss is an instruction to close an open position if the trade loses a certain amount of money or reaches a specific price point. If that happens then the stop loss is triggered automatically and the trade is closed at the next available price. In certain circumstances, compare forex brokers uk could mean that the trader experiences what's called slippage, and they can find that their stop loss has been executed at a price that's quite different from the trigger level.

To avoid that possibility, some brokers offer the option of guaranteed stop losses, which close a trade at the nominated stop loss level without slippage. However, there is normally a charge for trading with a guaranteed stop, and there are usually minimum distances that the stop will need to be placed away from the current price. MT4 or Metatrader4 is a trading platform built and designed by Meta Quotes, which was first introduced in The platform has become immensely popular with both brokers and traders.

Brokers liked the modular design and interoperability of the system. Whilst clients liked the trading interface, small download size and the ability to run and install expert advisors and other trading bots, MT4 also supports its own programming language, which meant that traders could craft and create bespoke algos for themselves. MT4 comes complete with a charting system, which is packed with built-in indicators and tools with which you can draw line, compare forex brokers uk or candle charts over multiple time frames, compare forex brokers uk, from minutes to months.

MT4 is available in desktop and mobile device formats and traders can switch seamlessly from one to another. There are thousands of MT4 brokers, and most use the same technology and provide similar market access. However, when choosing an MT4 broker, it is important to compare forex brokers uk at the features of the underlying forex broker. IG offers MT4, is publicly listed and compare forex brokers uk access to a wide range of markets.

Pepperstone's MT4 offering is very competitive on price. Saxo Markets caters more to professional or experienced traders and also offers MT4. For more information on MT4 brokers, you can compare MT4 brokers here. The phrase Day Trading refers to a style of trading that carries no overnight positions; rather, day traders enter and exit a trade within the same business day.

This serves two purposes: firstly, it eliminates overnight risk — that's price changes and news flow that can happen while you are asleep — and secondly, it means that traders don't incur any overnight financing charges or rollover swaps because their business is traded intraday. Compare forex brokers uk trading is a very popular trading style but of course, it does limit a trader's time horizons and tends to push them towards short-term swing and trend following trading strategies.

An FX day trader based in Europe might start their day by looking at what's happened to the major FX pairs in the Asian session and for price movements that look likely to continue in European trading or indeed those that look like they're running out of steam. What might a day trade look like? Let's imagine that the dollar-yen has changed overnight and the yen has continued to strengthen against the US dollar.

Headlines in the European and overnight press suggest US rates will remain lower for longer and a dovish Fed Governor and board member is speaking later that day. In these circumstances, our imaginary day trader might well sell dollar-yen expecting the rate to fall further.

In the late afternoon, towards the end of the UK business day, the Fed board member speaks and intimates that interest rates in the US will stay lower for longer and the dollar-yen FX rates fall, allowing our day trader to close their short position for a profit.

FX is largely a volume-based industry, which means that the more turnover you do, the cheaper your trading costs are likely to be or can be negotiated down to. Sometimes that reduction in fees will come in the form of a rebate, at say, the end of the month, rather than in the initial fees. However, as someone new to FX trading, you will want to look at the fees that you are going to be paying from day one, and most likely on smaller trades as you learn.

As we noted earlier, trading costs can be broken down into two areas: firstly, the bid-offer spreads; that's the difference between the buy and sell prices for an instrument. Secondly, trading commissions. Not all brokers charge trading commissions. However, some firms such as Pepperstone offer traders an account with discounted bid-offer spreads but which charge a commission per deal on top.

That arrangement works for traders who like known fixed costs and who trade higher volumes monthly, but it's certainly not for everyone. If you're looking purely at spreads, then eToro are among compare forex brokers uk cheapest on the street. Plus offers equally competitive headline bid-offer spreads in leading FX pairs, however, those headline rates are caveated by the phrase "variable".

There is no such thing as a free lunch they say, and that rings true in trading. Where brokerage services are offered free, for example, in trading US equities, the broker is paid by a market maker or high-frequency trader for their client's order flow. The adage that if something looks too good to be true then it probably is, remains good advice.

Best trading platform UK 2021 - Top 3 Forex Brokers in UK

, time: 19:3710 Best UK Forex Brokers In Sept [FCA Regulated]

21/02/ · The forex brokers comparison tool compares all forex broker ratings, features, and fees side by side. Filter your brokers and compare the the most popular brokers and widely used tools, mobile apps, platforms, spreads, and more. Please note: to best support your The best forex brokers according to reviews: The best FX broker in the GMG awards was CMC Markets. IG Group came top in the Spread Betting category. Whilst Pepperstone was voted the best MT4 broker, thanks to its tight spreads and the good range of products it offers 02/08/ · Best Forex Brokers UK Comparison IG Is The Largest FCA Regulated Broker In UK. IG is one of the oldest foreign exchange brokers in the world established eToro is the best Social Trading Broker. Most UK forex providers offer CFD trading. This means the trader doesn’t own FxPro Has the Best Estimated Reading Time: 12 mins

No comments:

Post a Comment