Consolidation on the Forex market is a kind of sideways (flat) price movement on a currency pair chart. The borders of such price consolidation can fluctuate in the range from 20 to points (naturally, it depends on the chosen Forex timeframe). This movement contains at least three candlesticks (in a row).Estimated Reading Time: 4 mins 21/07/ · Along with trends, consolidations are one of the three key market phases you need to navigate in forex and by far the trickiest. A single consolidation can whipsaw you for days, leading to many nasty, unnecessary losses – losses that could’ve been avoided had you properly understood the conditions blogger.comted Reading Time: 7 mins 12/03/ · A consolidationis a period of range-bound activity after an extended price move. Consolidation illustrates the lack of a trend in a particular trading range. Price has “consolidated”. It frequently occurs after downtrends or uptrends, and can be seen as a stretch of indecision

The Ultimate Guide To Understanding Consolidations - PriceActionNinja

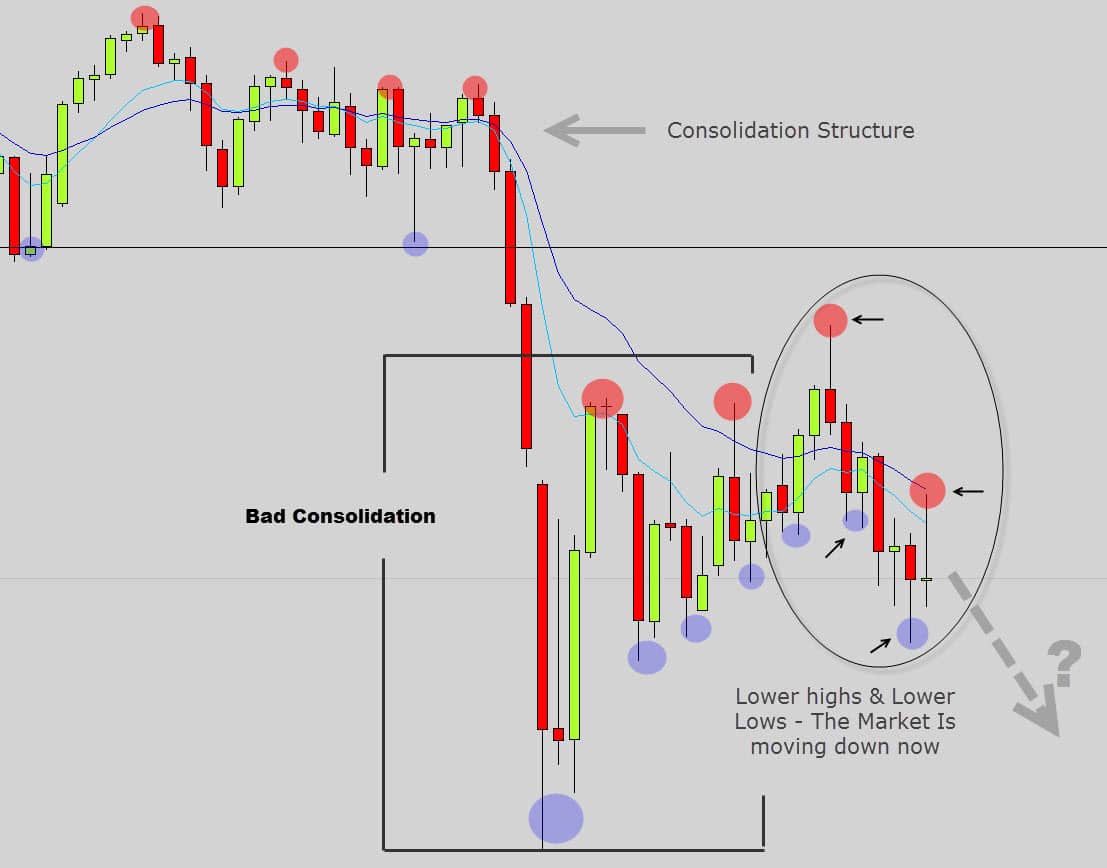

Along with trends, consolidations are one of the three key market phases you need to navigate in forex… and by far the trickiest. And once you know a few key facts about how and why they form in the market, they become very easy to deal with. e — the psychology behind them. The simplest way to describe a consolidation is a period in the market where price moves sideways rather than predominately up or down, such as in a trend, for example.

Price movement is made up of three phases: uptrends, downtrends, and consolidations, consolidate in forex. Trends are what cause price to move and change; they represent the overall consensus in the market. Consolidations, on the other hand, signal the opposite: indecision. As a result, price moves sideways to reflect their confusion.

Forex is one of the most consolidation heavy markets out there, if not the most. So it really pays to understand why they form so you know how to deal with them properly — more on this later. As you can see, it forms from price moving sideways: it swings down, then back up, down again and so on…. All consolidations you see, no matter which currency or time-frame they form on, follow this same basic pattern.

Most of the time, they form mid trend, signaling a small pause before a continuation. However, sometimes they also form at the end of trends, indicating a reversal. In fact, they use consolidations for their own purposes. And actually cause them to form in the first place for this consolidate in forex reason — sneaky, right? There are two reasons they could be taking profits….

The only different thing is the outcome: 1 results in a reversal; 2 in a continuation. This consolidation formed after a significant up-move and resulted in a continuation, which means the banks created it for reason 2 listed above.

Lets breakdown how this consolidation formed, so you can see how the banks placed their trades. All subsequent swings could terminate near the swing high and low of this swing, consolidate in forex, depending on how the consolidation takes shape, making them key points you need to watch for signs of a reversal, consolidate in forex.

At some point, the banks decide to place buy trades. This is when the downswing ends, and price begins moving higher again. However, knowing the consolidation resolved to the upside, it becomes obvious that this is the case and where the banks placed their first set of buy trades in this consolidation. As price moves back up again, retail traders — traders like you and me — start going long; they think the upswing is a resumption of the prior up-move. The banks know this, and in fact, want everyone to go long.

Once price reaches the highs of the first downswing, the banks decide to take profits again, setting off another downswing and causing most of the long retail traders to lose money. As a result, price falls back to the low of the first upswing. Remember, the banks always place their trades and take profits at similar prices. With everything placed, the banks now cause the breakout, consolidate in forex.

Usually, this will come without any prior warning. These tips will stop consolidate in forex from doing anything stupid when the consolidation forms. One of the biggest mistakes consolidate in forex can make trading consolidations is taking trades from levels and zones located in the middle of the consolidation rather than at the extremes.

However, aside from the odd trade, these points rarely result in reversals. Price moves from one side of the consolidation to the other, then it moves back again, and after that back to the other and so on, consolidate in forex. The banks can only buy and sell when they have traders doing the opposite; buying if they want to sell, selling if they consolidate in forex to buy. The lows of this consolidation, which the banks create from placing buy trades, all form at similar prices.

So each will make a similar amount of profit once price breaks out. Why this strange correlation you ask? Really, it comes down to two things:. The number of traders involved in the consolidation. The size of the trades the banks place to cause the consolidation to end. Consolidations become more and more obvious consolidate in forex time.

So the longer the consolidation, the more traders who participate in it. Because it means more traders will lose when price eventually breaks out! Think about it… many, if not most, of these traders, are going to get it wrong and be on the losing side of the market. You close a losing trade by doing the opposite of what you did to place it; to close a sell trade, you buy back what you sold; to close a buy trade, you sell what you bought.

If thousands of traders are short, consolidate in forex, for example, when a consolidation breaks to the upside, most will close their sell trades at a loss by buying back what they sold. However, they only trade according to the three main timescales: short term, medium-term, and long term.

These timescales are represented by the following time-frames:. Now, while bank traders have a lot of money regardless of the timeframe they trade, consolidate in forex, the longer-term traders have more because 1 it takes more money to move price on longer timescales, and 2 their outlook is much longer than the others.

And that scales based on consolidate in forex timeframes…. So 1h traders, consolidate in forex example, have a lot consolidate in forex money than 5 min traders, and daily traders even more than them. Longer-term traders can place significantly bigger trades than their shorter-term counterparts, resulting in much larger consolidations and stronger breakouts. A bank trader on the daily is placing trades according to what he thinks about the future price weeks or even months from now.

A 5-minute trader, on the other hand, is only concerned with the next few hours. He only needs to move consolidate in forex market a few pips, whereas the daily traders must make it move hundreds, potentially even thousands! However, sometimes the breakout will come after a stop run past the opposite side of the consolidation, making it a great early warning signal of which direction price will breakout — a signal you can use to get yourself into a good trade.

As a result, they split them up and place them at different but similar prices. All they need to do is push price into a large build-up of stop-loss orders… the stops will act as a counterparty and allow the banks to place their remaining trades without needing other traders to come into the market.

Consolidate in forex this breakout, price triggered a bunch of stops below the How do I know this is a stop run rather than a normal spike? The banks can see this, of consolidate in forex. They know stops have accumulated down here, so if not enough traders buy on the way back up, they know they can use these orders to place their last sell trades.

They need to find more buyers, so decide to push price above the high to trigger the stop orders. Price then moves lower before breaking out, putting an end to the consolidation and resuming the previous downtrend. Well, that about consolidate in forex it for today. I hope this guide has given you a better understanding of what consolidations are, how they form, and some key tips you can use to trade them safely. The Next Step?

Learn The consolidate in forex Rules For Trading Supply Demand Like A PRO Trader Take your trading to the next level. The psychology consolidate in forex why consolidations form, consolidate in forex. How to predict when a consolidate in forex will end using stop hunts. As you can see, it forms from price moving sideways: it swings down, then back up, down again and so on… All consolidations you see, no matter which currency or time-frame they form on, follow this same basic pattern.

Keep in mind, too… consolidations can signal either a reversal or continuation. Consolidations represent confusion; that we now know. How do they do this? There are two reasons they could be taking profits… 1. So first, the banks decide to take profits off their longs causing a counter-trend movement.

No-one knows it at the time, but this downswing is the first swing in the consolidation. You can probably already guess what happens next, right? With price back at the low or thereaboutsthe banks decide to buy again. Consolidations always follow the same basic pattern… Price moves from one side of the consolidation to the other, then it moves back again, and after that back to the other and so on.

It moves like this because the banks are placing their trades ready for the breakout. Does that make sense then, about why mid zones levels usually fail? Really, it comes down to two things: 1. Why does this affect the size of the breakout? In forex, the banks are active on all time-frames, both high and low.

These timescales are represented by the following time-frames: 5 min — short term 1 hour — medium term Daily — long term. And that scales based on the timeframes… So 1h traders, for example, have a lot more money than 5 min traders, and daily traders even more than them, consolidate in forex.

Well, the more money you have, the larger the trades you can place. And if you think about it, it makes perfect sense! To understand why this happens, we need to talk again about the banks. A stop run, of course. With a stop run, the banks can get easily enter their remaining trades without much hassle. So, consolidate in forex, how do the banks cause a stop run? Well, where do traders typically place their stop after a decline?

Above the most recent swing high, right? Once price hits the stops, the banks place their trades, resulting in a reversal.

95% Winning Forex Trading Formula - The Forex Master Pattern��

, time: 37:53All You Need To Know About Consolidations - Forex Mentor Online

21/07/ · Along with trends, consolidations are one of the three key market phases you need to navigate in forex and by far the trickiest. A single consolidation can whipsaw you for days, leading to many nasty, unnecessary losses – losses that could’ve been avoided had you properly understood the conditions blogger.comted Reading Time: 7 mins 24/02/ · Consolidations (often known as ranges) are some of the most challenging market conditions people face when trading the forex markets. Usually consolidations begin after there has been a long trend present in the market. Traders using indicators like moving averages who may well have been in a small amount of profit from the trend tend to lose it Estimated Reading Time: 9 mins 12/03/ · A consolidationis a period of range-bound activity after an extended price move. Consolidation illustrates the lack of a trend in a particular trading range. Price has “consolidated”. It frequently occurs after downtrends or uptrends, and can be seen as a stretch of indecision

No comments:

Post a Comment