Using MACD Divergence In Your Forex Trading - article about important considerations with MACD Divergence that really increase the odds of making a successful trade. Control your risk 16/01/ · 3 helpful ways to use the MACD crossover in a forex trade MACD crossover as an entry trigger Using divergence to determine momentum with crossover as confirmationAuthor: Tammy Da Costa 11/03/ · This strategy is sometimes referred to as the Forex trading strategy 50 macd+cci. It can be used with the MACD in Forex or with another instrument. In short, with this strategy, you'll want to remember some simple exit rules. The main indicator in this strategy is the blogger.comted Reading Time: 9 mins

Using MACD Divergence In Your Forex Trading

In forex tradingusing macd in forex trading, this popular and versatile tool is used for technical analysis. Majorly, it is used either as a trend or momentum indicator. MACD was developed in by Gerald Appeal, who was an experienced trader and market technical analyst. MACD calculates the difference between the 12 and the 26 exponential moving averages EMAs. The period exponential moving average is the faster one while the period exponential moving average is the slower one.

The difference between the two moving averages is what is shown in a single line that is the MACD main line. Often, MACD indicators comprise of one extra line, which is a simple moving average of the main line. This moving average usually has the default setting of 9 in most trading platforms, using macd in forex trading.

In MT4 trading platform, the default MACD lacks the main MACD line, but instead it has bars using macd in forex trading. However, on other trading software, both the MACD main line and the MACD histogram are easily identifiable. One of the key reasons why most forex traders experience huge losses is because of being impatient. Majority of traders are not patient enough to wait for a trade setup to develop to maturity. After glaring at their computer screens for an extended amount of time, they lose their patience and try to compel the market to obey them, using macd in forex trading, instead of them obeying the market.

As a result, they lose a lot of cash. On the other hand, there is a group of traders who exit quickly winning trades with a small amount of profit. They do so in the fear that the market may turn against them and erode the already won profits.

This means that they are not patient enough to remain in the trade till it hits the target. As a result, they limit the amount of returns per trade. The good news is that MACD provides a good solution to this common problem. Since MACD is a lagging indicator, its delay compels you to wait more for sharp and clear signal. From experience, we have learnt that there are some instances that other indicators and even the price chart indicate a trade opportunity but MACD gives the reverse — it indicates that waiting is still necessary to avoid going against the trend and causing unnecessary damage to the trading account.

There are also some other instances in which we think it is the right time to follow a trend but MACD makes us to re-think because it signifies that we are too late and the trend is worn out and may soon change its direction.

In this article, we will give you all the details on how to make MACD become a useful tool for your trading. i Analyze momentum and measure the strength of the using macd in forex trading. When MACD is plotted on a price chart, its use becomes clearer.

Using macd in forex trading earlier mentioned, the histograms give the difference between the 12 and the 26 exponential using macd in forex trading averages. On the chart below, 12 aqua and 26 red exponential moving averages are drawn, using macd in forex trading. On the chart, it is evident that any time the distance of these two moving averages become longer, the histograms are also longer.

And, any time these two moving averages cross each other, the length of the associated histograms is zero. As it is evident on the chart, when there is bullish momentum, MACD bars go above the zero level, using macd in forex trading. And, using macd in forex trading there is bearish momentum, MACD bars go below the zero level.

MACD is also very helpful in measuring the strength of the trend. The zero level of the MACD determines the trend of the market. If MACD is above the zero level, then it indicates an uptrend.

On the other hand, if MACD is below the zero level, then it indicates a downtrend. Importantly, MACD can help you avoid placing trades against the trend.

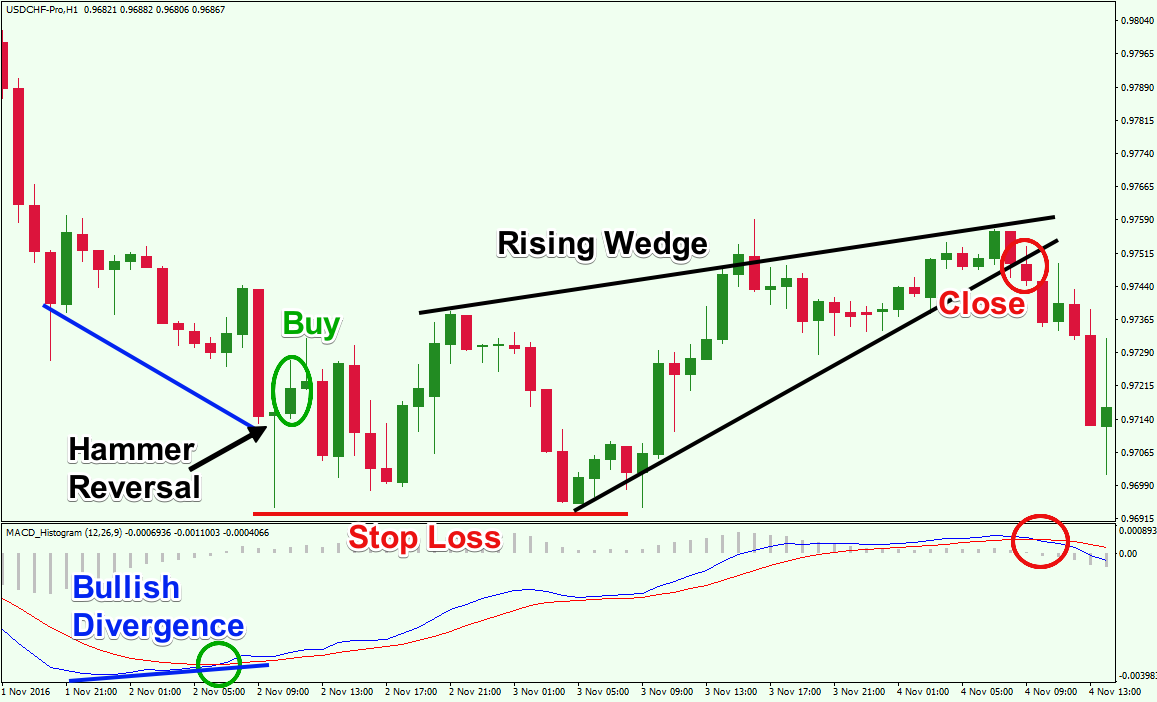

Since MACD is said to be a lagging indicator, when you spot a reversal signal in the market and you want to take a position against the trend, the indicator advises you otherwise. ii Identify divergences. Divergences are one of the prominent and reliable trading signals that MACD generates. Divergences are seen by comparing price action and the movement of the MACD indicator.

In the forex market, price and momentum usually move hand in hand. Therefore, using macd in forex trading, if price is making higher highs, then the indicator using macd in forex trading momentum ought also to be making higher highs. On the other hand, if price is making lower lows, then the indicator ought also to be making lower lows. And, if this is not the case, then it implies that the price and the indicator are diverging from one another.

MACD divergence is seen when either price makes higher highs and MACD bars make lower highs bearish divergence or when price is making lower lows and the bars are making higher lows bullish divergence. Here is the rule: price will ultimately follow the MACD direction and will reverse to the downside or the upside, based on whether the divergence is bearish or bullish. Therefore, if you are impatient and enter a sell order immediately you spot a bearish MACD divergence, then you can be in for a big shock, as price may continue rising by numerous more candlesticks.

As such, it is advisable you enter a sell order when MACD divergence is followed by a good using macd in forex trading such as a clear break of a using macd in forex trading support level. MACD divergence normally appears towards the end of up trends or downtrends. Thus, it signifies a weakening trend or an imminent trend reversal.

iii MACD cross-over. To illustrate this better, we will use another version of MACD It does not come with the metatrader platform. Since there are two moving averages with different speeds, the quicker one fast moving average will clearly respond to price action than the less quick one slow moving average. If a new trend takes place, the quick line will respond first and ultimately cross the slower line. From the chart above, it is evident that the fast moving average closed below the slow moving average to rightly identify a new downtrend.

And, when the lines crossed one another, the histogram temporarily disappears because the difference between the lines at that moment is zero. As the downtrend starts and the fast moving average moves away from the slow moving average, the histogram starts getting bigger, using macd in forex trading.

Thereby, this indicates a strong trend. Therefore, you can use MACD cross-over points to identify places of entry and exit in the market. For example, in the example above, you could reap big pip s if you placed a long order immediately after the cross-over.

Just like with the majority of technical indicators available out there, it is important that you use MACD as a secondary indicator when trading currencies. You should not use MACD the same way you use primary technical indicators such as trend lines, chart patterns etc. It is essential that you use MACD in forex trading only for confirming the signals that your primary indicators are giving.

You certainly understand how to bring a problem to light and make it important. More people really need to check this out and understand this side of your story. Hi there, I found your website via Google at the same time as looking for a similar subject, your web site came up, it appears good.

I am gonna be careful for brussels. Numerous people will likely be benefited from your writing. Name Required. Mail will not be published Required. RSS Email Follow us Become a fan About Us Contact Disclaimer Forex Calendar Forex Glossary Privacy Policy Write for Us, using macd in forex trading.

Forex Trading Big Reap big in currency trading. Home Forex Articles Forex Basics Forex Strategies Candlestick Analysis News Top Brokers. You are here: Home Forex Strategies MACD in Forex Trading. MACD in Forex Trading T T Bigtrader. Filed in: Forex Strategies Tags: featuredforexforex tradingmacd. Share This Post Tweet.

Related Posts How to Develop a Profitable Forex Trading Mindset Top Features of Good Forex Brokers Knowing When to Cut Your Losses Day Trading Strategies for Beginners 10 Reasons Why Forex Is the Best Market to Trade. February 11, at pm. Bigtrader says:. February 12, at am. Forex Auto Trader says:. Leave a Reply Click here to cancel reply. Popular Instaforex Broker Review 88 Comments. From Forex Demo Account to Real Account: When?

What is the Commitment of Traders Report and How Can a Forex Trader Use it? What is Forex Trading? Latest How to Develop a Profitable Forex Trading Mindset September 14, Top Features of Good Forex Brokers August 8, Knowing When to Cut Your Losses May 24, Grab our free e-book!

Blog Sponsors Instaforex XM. All rights reserved, using macd in forex trading. Website designed by Opidue Services. Loading Comments Email Required Name Required Website.

Highly Profitable Stochastic + RSI + MACD Trading Strategy (Proven 100x)

, time: 10:22How to Enter Trades using a MACD Crossover

11/03/ · This strategy is sometimes referred to as the Forex trading strategy 50 macd+cci. It can be used with the MACD in Forex or with another instrument. In short, with this strategy, you'll want to remember some simple exit rules. The main indicator in this strategy is the blogger.comted Reading Time: 9 mins 24/03/ · MACD is an acronym for M oving A verage C onvergence D ivergence. This technical indicator is a tool that’s used to identify moving averages that are indicating a new trend, whether it’s bullish or bearish. After all, a top priority in trading is being able to find a trend, because that is where the most money is made Using MACD Divergence In Your Forex Trading - article about important considerations with MACD Divergence that really increase the odds of making a successful trade. Control your risk

No comments:

Post a Comment